There’s nothing like a smile on a child’s face when they’ve reached a goal.  The Softball Chef, Equestrian Girl Forever and Fashion Diva Girl all had the biggest smile the day we said, “yes, Carlos will be joining us in Hawaii.”  No, I wasn’t going to actually leave him, but we told the girls they had to help pay the fees to ship him here.  The agreement was half.

When families PCS (military move) there are costs associated with moving pets that must come out of our own pockets. Â There is also a process that happens depending on the country (in this case, we remained within the US, but Hawaii has different regulations based on their agriculture guidelines).

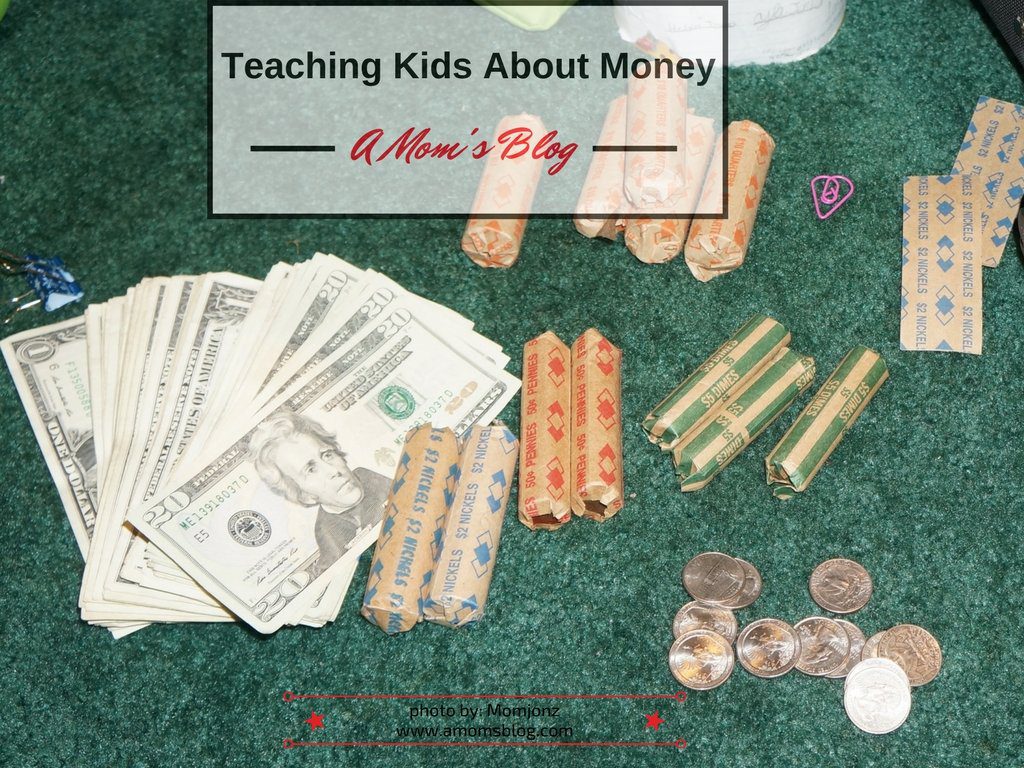

Determining The Costs

The first thing I had the kids determine was the cost. Â That’s right, you can’t budget if you don’t know how much things will cost. Â So, they did a quick search online about bringing pets to Hawaii. Â They learned what tests, vaccines, etc. were needed. Â They also learned the timeframe they needed to have these things completed by.

We contacted our Military Vet to make an appointment.  The initial call was to ask the costs of required tests and vaccinations.  I also told them to ask about the price of the office visit and any other administrative fees. It’s best to get all expenses in advance to have a good solid savings plan. After calculating this, we took a quick look at airfare for Carlos. Airfare varies from airline to airline, as well as on if you are flying on orders with your dog onboard.  This is where it got a little tricky for us. There was an issue with our booked flight, but that’s for another post.

The Savings Plan

So, we now have an estimated cost. Â We were looking at about $800. Â I told the kids $1000 just in case. Â It’s never a bad idea to plan a little extra. Â The three came together and realized they had a little over 8 months to save $500; their half. Â The first installment was due in about 4 months because we needed to start the FAVN.

Each child receives an allowance, plus money for grades and funds for birthdays, holidays and whenever grandparents want to send them something. Since they are paid $5 per year of their age, they set a percentage amount that each child had to contribute every month. Â They also did odd jobs around the house and pulled money from their short term savings for spending purposes. Â I must say, I was one PROUD mama!

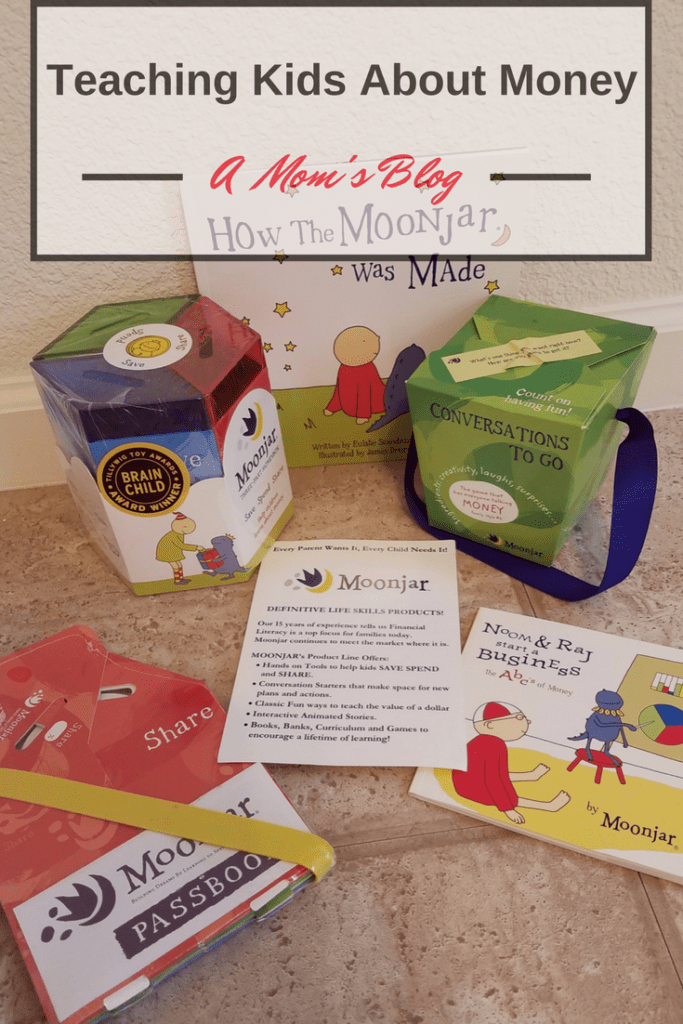

The Moonjar Family Kit

Our Teaching Of Savings

The concept of savings is something we’ve taught our kids early on, but we hadn’t focused on the specifics with our youngest at this point. Our biggest financial lesson to our children is to ALWAYS tithe 10%. Â No, we are not the family that believes you should only give your money to a church. Â We teach our children to give where their heart leads them. Â I’ve witnessed my kids give money to the homeless, animal associations, even buying friends gifts to brighten up their week. Â To me, this is what tithing and being a cheerful giver is all about. Â

After watching how much our youngest enjoyed saving and planning out ways to help save for shipping Carlos I decided it was time to get a technic in place for her. Â The process with her was simple…ok, here’s your allowance, put x amount in your wallet, x amount is going to the bank. Â There was no talk of tithing or short term saving with her. Â Why? Â She was always willing to give a dollar here or there. Â But, it was time to actually “TEACH” her.

Why The Moonjar To Teach My Child About MoneyÂ

So, the BANK.  The Moonjar has 3 separate boxes…a share, a spend and a save box.  It’s really cute with different colors that form a cube.  As I watched our youngest share her money and her two cents on how they would save the required amount I knew it was a must to implement a plan for her.  Unlike her sisters, Fashion Diva Girl likes things organized, tidy and colorful. Her sisters will keep their money in a shoebox, a pickle jar and even a plain white envelope.  Not this little one.

After researching bank gadgets and containers, I came across the Moonjar. Â I liked it because it is a Tillywig Toy Brain Child Award Winner, it’s colorful, and it’s transparent. Knowing that my daughter loves seeing the “increase” of her money, it was a winner.

We received the Family Kit, and I loved the little book telling the story how the Moonjar was made. Â Kids love books with illustrations, and this book has a simple, colorful story for kids to relate to Noom and Raj on their savings, spending and sharing journey. Â The family kit also comes with a game. I don’t know about you, but we love playing games in our house. Games are always a great way to educate our youth in different areas by making it fun.

Be sure to come back for more about Fashion Diva’s savings adventure with the Moonjar. Â I will also go into more detail on when, how and why we started our financial conversations with our kids. Â I think I need to get 2 more for the other kids. Â Great lesson for kids!

MomJonz did receive the Family Kit to review for this post. Â All opinions are mine and not influenced by the company. Â

Do you want to join a fun, supportive group of women? Come on over to our supportive, loving and fun facebook group. Mamas and Coffee® is all about the REAL of womanhood. Join Us.

Do you want to join a fun, supportive group of women? Come on over to our supportive, loving and fun facebook group. Mamas and Coffee® is all about the REAL of womanhood. Join Us.

- You Don’t “Look” Like You Had a Stroke: A Chat with My First Strokie Friend, Fred Reader - February 5, 2026

- What Is A Mini Stroke - November 21, 2025

- My Journey with Anxiety After Stroke - November 20, 2025

the earlier the better, my parents taught me at a young age, and I love them for it

It goes a long way in life and will stick with you.

I love that you had your kids research how much it was going to cost to move Carlos instead of just telling them it will cost “x” amount of dollars. I’m sure they learned so much more by knowing how all the money was being spent instead of just how much it would cost!

Kids tend to think money just comes from the sky. I wanted them to understand that everything has a price and the time required to gather the cost of things too. Thanks for stopping by.

I love that Moonjar has three separate boxes for sharing, spending, and saving. Right now my son just puts everything into his wallet or piggy bank, and then pulls out whatever amount when he wants to go shopping. So he has troubles saving for bigger items, because he spends it all at one time, or he just doesn’t buy anything for a long time. I like the idea of setting aside a bit of his allowance each time to saving and spending (he already sets aside 10% for tithing). Thanks for the suggestion!

Yes. I love the 3 compartments. I like the idea of keeping the money separate, then they can see what they have for each area vs. spending it all in one shopping trip.

This sounds awesome! I’m the same way with my 4 year old. People always think it’s crazy when I say she’s bought something for herself but she has been practicing saving, sharing and spending since she was barely walking. She’s currently saving to buy me a Valentine’s gift (her idea lol)

That’s so sweet. People look at me crazy when they hear my kids say they paid for something. Necessities we pay for, but you want certain items we must learn a value of a dollar. You’re rocking this finance thing out!

Teaching children about money from an early age is really important. It will set them up for a healthy and prosperous adulthood. My parents made us put a portion of our allowances into our bank accounts when we were little to teach us the concept of saving.

Gennifer Rose | http://www.GenniferRose.com

It really does make a difference. They will have a system in place when they become adults. At least, that’s my thinking. 🙂