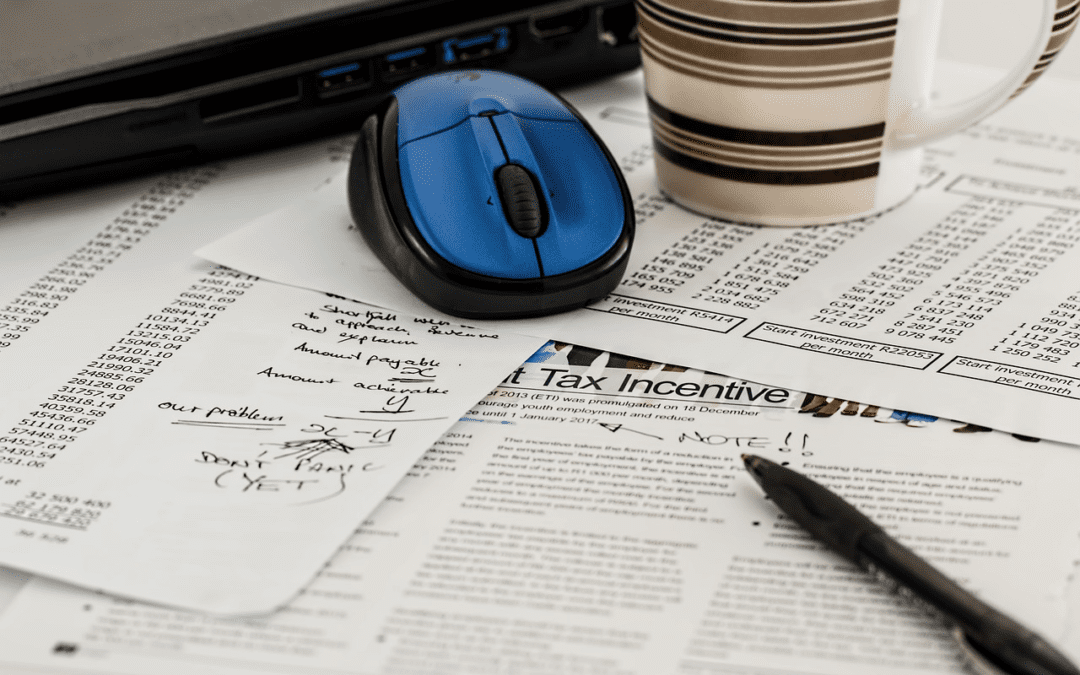

There are a lot of responsibilities that you have to be ready for when you start a business. You can pile even more of them on when you start to take on employees, as well. However, in particular, it’s always worth noting the decisions that can affect how you have to do your taxes. When you hire an employee, there are tax responsibilities that you take on, too. Here, we’re going to look at how you manage them, so that you can go on with running a successful business.

Depositing your employment taxes

The taxes that you have to pay the state government are going to vary depending on where, exactly, you are. However, there are federal tax obligations that you have as an employer. For one, you have to withhold federal income tax, Social Security, and Medicare taxes from your employee’s paychecks before you pay them, and you should be depositing these either monthly or semi-weekly. Make sure you have an organized approach to doing it, because you can end up paying up to 15% more if you’re late.

Managing accurate reports

Aside from paying your employment taxes, you need to make sure that you accurately report them, as well. You have to file reports on all of the federal income taxes that you have already paid and find the appropriate files to do so. It’s important to keep records for yourself, as well, so that if the IRS comes asking any questions at some point, you have complete, accurate, and organized records to show them that should back up their own records.

Ensuring you’re registered

However, you can only do the above if you have registered your business federally. You have to do this if you have to pay any federal taxes, are opening a business bank account, or have any tax-deferred pension plan, but most businesses have to do it when they hire employees. If you do, then you need to fill out a FEIN application. You will have to include this number on any federal tax forms that you are submitting. It’s much like an individual tax ID number (ITIN) or an SSN, except it identifies a business rather than an individual.

Providing a W-2

You also have to ensure that you’re enabling your employees to meet their own tax responsibilities, as well. Primarily, you have to provide them with a form W-2, also known as a wage and tax statement. You send these out at the end of the tax year, reporting their wages and taxes withheld. You also have to submit a copy to the IRS. If there are any discrepancies, it is your responsibility to manage, not the employee’s It’s worth noting that you don’t have to provide this for self-employed workers that you have outsourced to, of course.

If you want to make sure that you’re doing your taxes right, then it’s always a good idea to consider working with an accountant. Aside from balancing your books, chartered accountants and qualified to offer legal advice regarding how you handle your taxes.

Subscribe to our newsletter for more FABulous content.

Do you want to join a fun, supportive group of women? Come on over to our supportive, loving and fun facebook group. Mamas and Coffee® is all about the REAL of womanhood. Join Us.

Do you want to join a fun, supportive group of women? Come on over to our supportive, loving and fun facebook group. Mamas and Coffee® is all about the REAL of womanhood. Join Us.

- How To Deal With Your Cluttered Home (Once And For All) - July 10, 2025

- 3 Ways to Add More Excitement to Your Career - May 27, 2025

- 5 Essential Tips for a Healthy Pregnancy Journey - May 23, 2025