Creating a budget for your business requires you to have a handle on your finances and know where the money will come from and what you need to pay out even before you make your first dime. Having the funds and resources to help you cover your costs is vital, as is knowing how and where you will generate a profit to pay for your expenses once your initial funding is used up.

So, what do you need to factor into your budget when starting your business? Well, contrary to popular belief, it is not just one budget you need but rather a series of smaller budgets for different aspects of the business that then come together to give you an overview of your projected spending.

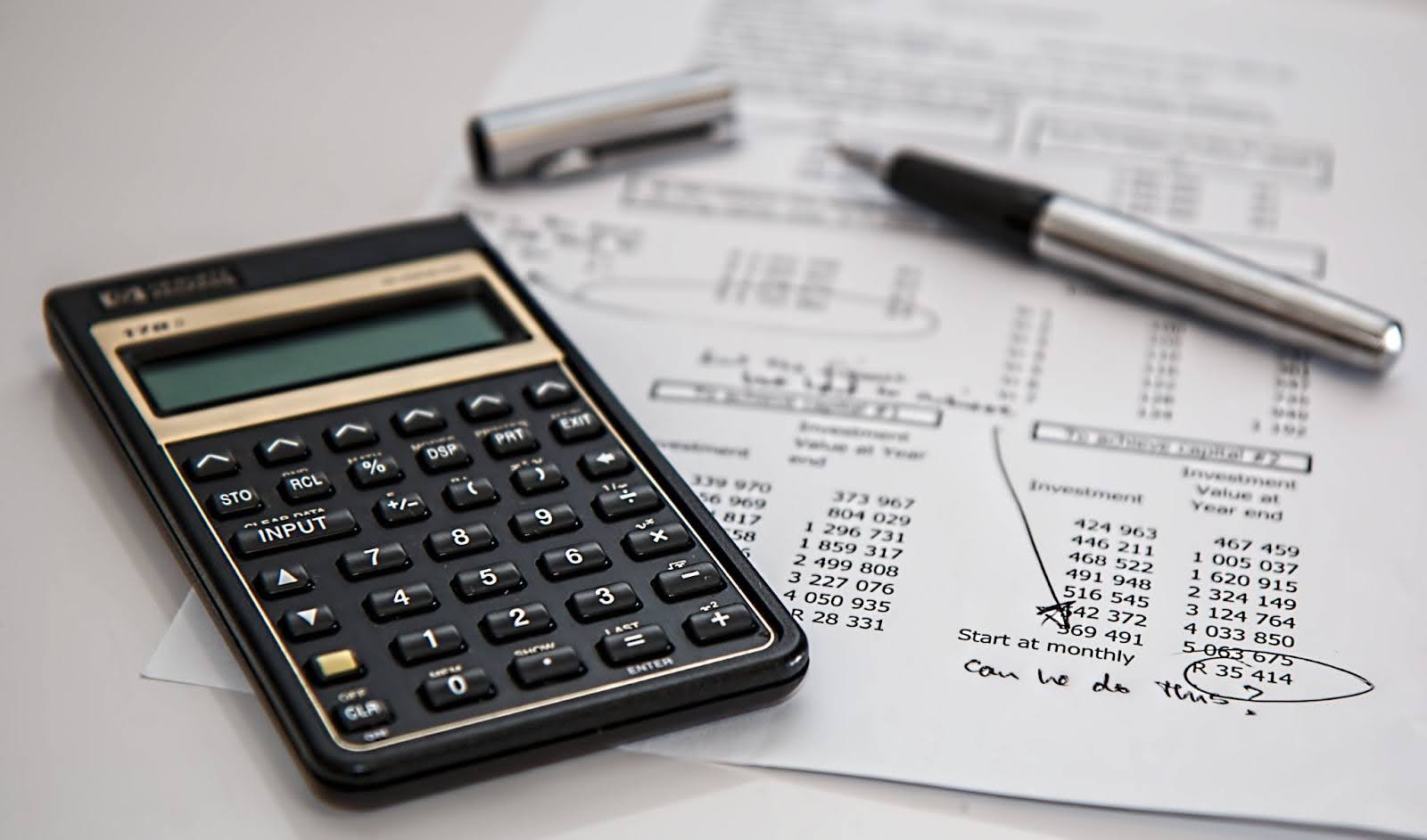

Main Budget

Your principal or primary budget is made from your financial forecasts, financial information, and cash forecast to help drive the decisions in the business. It will be the one you refer to reach your business goals. Most companies use a spreadsheet or budgeting software to help them create this budget and see what is going on in all business areas.

Operating Budget

Your operating budget will include fixed and variable costs and nonoperating expenses. This will help give you a projected revenue and expenses overview for any time. The things you need to have at this point are fixed costs that occur monthly, such as business owners policy payments, utilities, rent payments, software costs (i.e., outsourcing partners), and anything that you need to pay regularly that is a fixed payment or variable to keep operating.

Labor Budget

Your labor budget is exactly how it sounds. It’s a budget that you use to track payroll for any permanent or seasonal staff you will be hiring. This can include any benefits you will need to pay them, worker compensation payments, PTO, sickness pay, and bonuses, for example. If it is a cost relating to your employees, it goes into your labor budget.

Cash Budget

Your cash budget is derived from your sales forecasts and production by estimating payables and receivables. This gives you an idea of the cash expected within the business, and you can see what is coming in and going out within a specific timeframe so you can see the cash available to use.

Capital Budget

A capital budget covers nonrecurring costs and requires you to make considerable investments in the business. This could be buying buildings to operate from, equipment or machinery that needs to be replaced or to improve what you do. These are expenses that you wouldn’t typically pay for regularly, but you need to have funds set aside for and actores into your budget on a yearly basis or less frequently.

When combined, all of these different budgets will give you a deeper insight into where you stand financially and can help you to drive better decisions to support your business without worrying about whether you have the money available or what position you are in. By creating multiple budgets, you can quickly know what is happening in different areas of your business.

Do you want to join a fun, supportive group of women? Come on over to our supportive, loving and fun facebook group. Mamas and Coffee® is all about the REAL of womanhood. Join Us.

Do you want to join a fun, supportive group of women? Come on over to our supportive, loving and fun facebook group. Mamas and Coffee® is all about the REAL of womanhood. Join Us.

- No Makeup, Real Talk, and Squirrel Moments: Mamas and Coffee Gets a Show! - January 23, 2026

- What Are The Types of Stroke - November 22, 2025

- What is Carotid Artery Thrombosis? - November 17, 2025